[A]s of April 1, the U.S. now has the highest corporate tax rate in the developed world.

Our high corporate tax rate has long made the U.S. an uncompetitive place for new investment. This has driven new jobs to other, more competitive nations and meant fewer jobs and lower wages for all Americans.

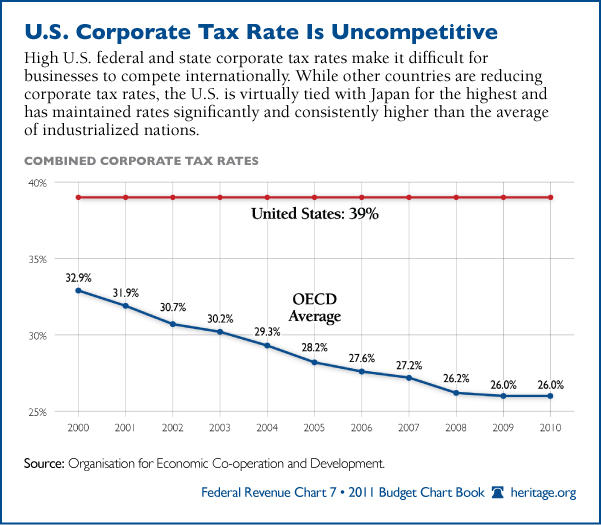

Other developed nations have been cutting their rates for over 20 years. The U.S. did nothing....

Japan’s rate was 39.5 percent. That was just barely ahead of the U.S. rate of 39.2 percent (this includes the 35 percent federal rate plus the average rate the states add on). Japan’s rate now stands at 36.8 percent after its recent cut.And if you think that 15 percentage-point disparity is bad, IBD explains that it's actually much, much worse when you look at some of the United States' peers:

The U.S. rate is well above the 25 percent average of other developed nations in the Organization for Economic Cooperation and Development (OECD). In fact, the U.S. rate is almost 15 percentage points higher than the OECD average. This gaping disparity means every other country that we compete with for new investment is better situated to land that new investment and the jobs that come with it, because the after-tax return from that investment promises to be higher in those lower-taxed nations.

Our high rate also makes our businesses prime targets for takeovers by businesses headquartered in foreign countries, because their worldwide profits are no longer subject to the highest-in-the-world U.S. corporate tax rate. Until Congress cuts the rate, more and more iconic U.S. businesses such as Anheuser-Busch (which was bought by its Belgian competitor InBev in 2008) will be bought by their foreign competitors.

Great Britain was to cut its corporate tax rate on April 1 to 24% from 26% and will cut the rate again to 23% in 2013.I guess it's appropriate that the United States becomes the world's worst corporate taxer on April Fools Day. The chart above makes abundantly clear that American companies and workers have been played for fools by our elected officials.

On Jan. 1 of this year, Canada cut its federal corporate tax rate to 15% from 16.5%.

Canada's combined rate is 26% when the average rate of the Canadian provinces is added to the federal rate. Coupled with an unfettered energy development policy, Canada's tax policy creates a low-cost, business-friendly environment....

It was the final link in Canadian Prime Minister Stephen Harper's pro-growth Economic Action Plan. There is no railing against corporate greed and oil companies north of the border.

What on earth are we thinking?

No comments:

Post a Comment